SFR Acqusition #16 – 8259 Meyers Street, Growth, Growth, Growth!

SFR Acqusition #16 – 8259 Meyers Street, Growth, Growth, Growth!

We at Mutual Trust Management Advisory LP offer our investors a long term residential real estate investment opportunity with an aggressive outlook as per below.

- 8% Annual Preferred Return to our investors.

- A Target Total of 10 to 16% Annual Returns

- The difference will be split by investors and general partners.

Many real estate investors may wonder, how is this possible, when retail residential purchases at today’s prices can only typically produce a 3 to 4% cash-on-cash return if lucky?

We are here to offer individual investment details of each property that goes into our portfolio in order to show our investors exactly how this is done.

The typical investment thesis is that firstly, we purchase a value-add property and fix it up to create immediate equity growth. The equity will then keep appreciating at a compounded rate far superior to a typical retail play.

Then, we ascertain that enough cash flow from the rents are available to secure most of the Preferred Returns. While most properties may not start at a cash-on-cash return of 8% and more, we do look for properties that can deliver this goal within a few years’ holding period.

Of course, we employ further tweaks to accommodate detailed portfolio management, however in this article we will keep the framework simple.

Let us take the example of 8259 Meyers Street, a recent proud acquisition.

- Property Address: 8259 Meyers Street, Detroit, Michigan 48228

- Acquisition Date: 10/11/2024

- Acquisition Price: $90,000

- Capital Expenditures (CapEx): $20,000

- After Repair Value (ARV): $140,000 (conservatively).

- See Comp 1 A comparable property of similar size, fully renovated and vacant, sold for $169,000.

- See Comp 2 A smaller property requiring a comprehensive cosmetic refresh, sold for $120,000.

- See Comp 3 A smaller property with a long-term tenant and a listing history of $149,999

- Current Rent: $1,000 per month (projected to increase to $1,200 immediately post-closing).

- Simple Cash-on-Cash Return Projection: 7%+ after rent increase

8259 Meyers Street is a promising brick property situated in the small but well-maintained Aviation Sub neighborhood of Detroit.

Aviation Sub is known for its well-kept homes that feature a variety of architectural styles, including bungalows, colonials, and ranches. The predominantly brick construction adds to the area’s visual appeal and long-term durability, making it a highly desirable choice for residents and investors alike.

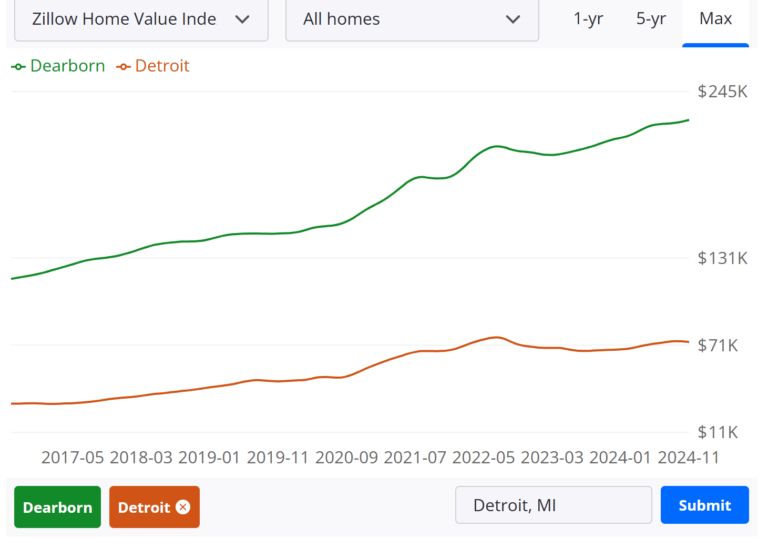

Recent interest in this neighborhood stems from its proximity to Dearborn, a vibrant community known for its Middle Eastern culture and landmarks. Dearborn real estate prices are now more than three times the value of typical Detroit properties. This makes the Aviation Sub neighborhood attractive to families seeking affordability with convenient access to Dearborn.

Dearborn real estate has outpriced and outpaced Detroit, and is set to boom further.

The locational advantage of 8259 Meyers Street places it just minutes from key growth hubs, including:

- Islamic Center of Detroit (ICD)

- Qahwah House coffee shop on Shaefer

- Numerous Arabic bakeries and restaurants on West Warren Avenue

- Many fresh foods supermarkets such as the Happy Land Market and Super Greenland Market

- Entertainment such as the Ford-Wyoming drive-in theater and other essential services such as a dental clinic on Ford Street

According to Zillow, the zip code 48228 has appreciated over 12% year-over-year from December 2023 to December 2024. This outpaces Detroit’s 7.9% growth and Dearborn’s 6.9%, reflecting the rising spill-over demand in this still-affordable area.

The accessible home values and renovation opportunities still to be found in this area is likely to continue to attract investors and homebuyers, driving further gentrification.

As already mentioned, at MTMA, we structure our single-family residential (SFR) acquisitions strategy to align with the below metrics.

- Preferred Return Rates of an annualized 8% to investors

- Overall target annualized returns of 10–16%

The majority of the Preferred Returns will be provided from the yearly rental cash flow. The remainder of the returns will occur from the value creation.

This property is projected to gain a conservative equity return of 27% upon renovation completion (total investment: $110,000; ARV: $140,000) as well as achieve a cash-on-cash return of over 7% once the rent increase occurs.

Combined, the Team estimates a first-year total return of approximately 34%, effectively doubling the fund’s total annual return expectations of 10-16%.

This first year will be followed by annual equity growth on the ARV and rent increases. Let us assume the area property prices appreciated by 5%, a very conservative rate judged against the recent trends and this exceptional location. In Year 2, this property will be returning:

- 5% appreciation against $140,000. This is 6.38% against the original investment amount of $110,000.

- $50 increase on the $1,200 rent, or 4.1% rent increase. This will produce a cash-on-cash return of 7.64% against the original investment amount.

The Year 2 returns goal against our original investment amount is estimated to be 14% if no major incidents, and our numbers will grow further into the future years, positioning this investment comfortably above and beyond our fund goals with the initial value creation offering a performance reserve for possible market variability.

This is how our investors can rest assured that our strategy—targeting an annualized portfolio growth of 10 to 16%, with 8% allocated to investor Preferred Returns—is typically shown to be achievable within a few months of acquisition.

Every acquisition will have a similar specific investment thesis that aligns with the above goals, and investors will have a good idea, typically within the first half year of each acquisition, whether the benchmarks are being achieved or not.

Based on the two key metrics of rental cash flow potential and equity creation, the successful acquisition of 8259 Meyers Street stands to demonstrate our fund’s ability to deliver and perform.

===== December 30, 2024 Update

The property lease was renewed to $1,200 a month on 11/1/2024. The repairs on the roof, landscaping, and kitchen floors were immediately ordered and made also at this time.

The property is now safely set to a cash-on-cash return of above 7% as we have projected.

In relation to value creation, on December 30, 2024, this property has a Zestimate of $115,600 on the popular real estate website, Zillow. This gap between our Comparative Market Analysis performed by veteran local listing agents may occur from time to time due to the nature of our acquisition and value creation styles. We purchase properties typically not listed openly, and fix them up without listing them again.

While achieving a top-market price through a MLS listing might indeed require additional cosmetic repairs (see Comp 1), we confidently stand by the as-is valuation of $140,000 (See Comp 3).

© All Rights Reserved.