SFR Acquisition 1: 6190 Harvard Street in the Highly Desirable East English Village

SFR Acquisition 1: 6190 Harvard Street in the Highly Desirable East English Village

- Property Address: 6190 Harvard Street, Detroit, Michigan 48224

- Acquisition Date: August 8, 2024

- Acquisition Price: $73,860

- Capital Expenditures (CapEx): $35,000

- After Repair Value (ARV): $150,000 to $155,000 (conservatively) See Comp 1, Comp 2, Comp 3.

- Potential Rent: $1,200 per month (conservatively)

- Simple Cash-0n-Cash Return Estimate: 9%+

6190 Harvard is a charming brick building located in the highly sought-after East English Village neighborhood, just north of Grosse Pointe.

To place this location into context, Grosse Pointe began as a retreat for Detroit’s industrial elite in the late 19th and early 20th centuries, attracting prominent families who built grand estates along the waterfront.

Today, Grosse Pointe and its neighboring cities remain synonymous with elegance, boasting excellent schools, vibrant shopping districts, and a rich cultural heritage.

This proximity to Grosse Pointe adds significant appeal to Detroit’s East English Village, offering residents a unique blend of Detroit’s affordability and access to the amenities and lifestyle of a highly exclusive neighborhood.

This strategic location has turned the East English Village into one of Detroit’s most stable and well-maintained communities with a track record of historical appreciation, providing excellent long-term investment potential.

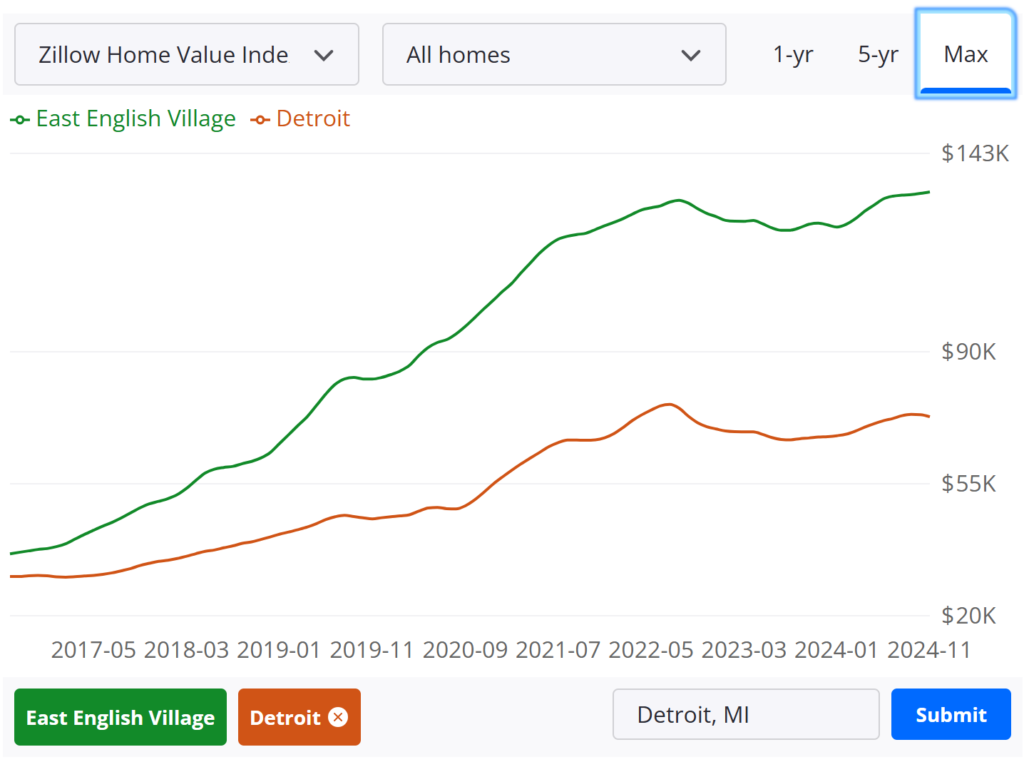

Zillow historical area appreciation for East English Village against Detroit

Here in the Midwest, because weather conditions can be quite severe on building structures, the local residents generally prefer a brick building. Vinyl siding is durable and resistant to moisture and insects, but it can be susceptible to impact damage and fading over time. In contrast, brick provides superior durability, weather resistance and longevity, which makes it a long-lasting choice. This can sometimes even affect property resale value, so investors will see that when possible, the Mutual Trust Management Advisors Team will always prefer to acquire a brick building in a mostly brick street.

Here is a street view around the Subject Property, courtesy of Google Maps.

With Detroit’s largest property management company overseeing the renovation as well as tenant screening, the stabilization date is projected to be within 4 to 5 months after closing.

========== Property Update on December 31, 2024

Repairs for this property were successfully completed, and it was rented for $1,270 per month on November 19, 2024—$70 higher than our original projection. The December 2024 statement confirms that the property is performing at or above initial estimates.

Performance Highlights:

- Equity Creation: 54% (Initial investment: $103,860; ARV: $160,000)

- Net Rent Return: 9%+ ($1,270/month)

- Total First-Year Return: 65% annualized following stabilization in just 3 months

Zillow now reflects our ARV, with a Zestimate of $160,180 as of December 2024, boosted by showcasing after-repair photos.

Second-Year Projections:

- Net Rent Increase: $50/month (+4%) would bring the cash-on-cash return to 9.6%.

- Appreciation: A 5% ARV increase equates to a 7% return on the initial investment.

- Total Second-Year Return Target: 16.6%

After the second year, the property is expected to enter a similar steady growth phase, consistently delivering returns in line with our fund goals of 10–16% annually.

Again, as is the case with all of the value-add properties we introduce into our fund, the first year’s value creation will serve as a reserve or equity cushion, safeguarding against unexpected costs or even market shifts, ensuring the fund achieve its annual goals for the long term.

© All Rights Reserved.